It means that the country invests abroad more than it invests in its own nation. A country usually invests its funds abroad for a certain period of time and it is referred to as net capital outflow. Net capital outflow can be defined as the investment of funds in a different country. When big American corporations issue bonds to raise capital, which is then purchased by foreign investors, then those payments are also to be made in Dollars. When developing nations buy anything from the US, they have to convert their local currency into Dollars to make the payment. The supply of Dollars is created when the United States exports the product or service and creates a demand for it in return. The goods that are exported by the US generate the demand for Dollars because customers pay for their purchases using the currency. Supply and demand factors highly affect the value of the Dollar.

India imports commodities from the US instead of exporting on its own which is why the value of the Dollar is high due to the number of exports.

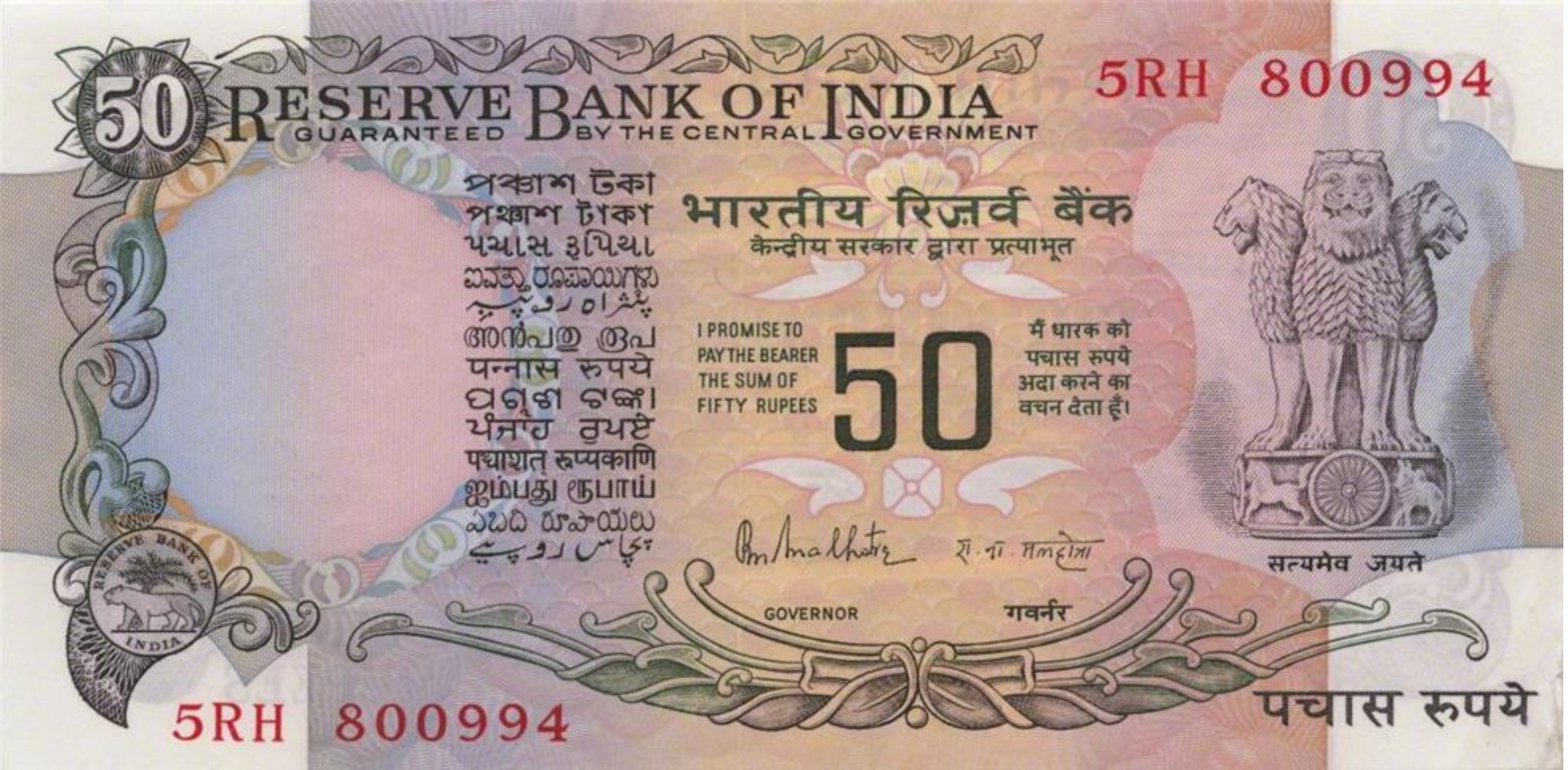

The US Dollar is higher than the Rupee for various reasons. Imports become more expensive as the value of a foreign currency rises, whereas exports become less expensive. In the global foreign exchange market, the exchange rate changes every day, and it is an essential indicator of a country’s economic strength. The value of one Dollar to one Indian Rupee fluctuates, referred to as the exchange rate.

The Indian Rupee is valued less compared to the US Dollar.

0 kommentar(er)

0 kommentar(er)